Pretty much every brochure advertising forex trading highlights the fact there is no such a thing as a bear market in forex. Stocks, bonds, and commodities can all lose value simultaneously (as happened when Lehman Brothers declared bankruptcy in October 2008) but it’s impossible for all currencies to decline simultaneously. A bear market in the Euro might be offset by a bull market in the Dollar; or Swiss Franc; or Brazilian Real. Regardless, you don’t have to search far to find currencies that are outperforming, whereas a stock picker would certainly have his work cut out for him during an economic recession.

I remind you of this cliche because in the current market environment, it has apparently taken on new significance. Anecdotal reports of investors frustrated with stocks, or having been burned by China, or disappointed by the collapse in oil, are flocking to forex by the thousands. Angry about suspended trading rules on stock markets? This could never happen in forex (at least not under current rules), since currencies are traded on multiple exchanges linked through a decentralized system.

Here are the stats: at Forex.com, “New accounts have increased about 30 percent a month in the last six months from pre-September levels, while the number of trades per day has risen almost 50 percent. GFT Forex said trading volume rose 187 percent from late 2007 to late 2008….By the end of 2006 [the last year apparently for which this type of data is available], average daily trade volume reached over $60 billion, a 500 percent increase from 2001…Trading volume generated by ‘retail aggregators’ — electronic trading platforms that cater to individual retail traders — rose almost 43 percent from 2007 to 2008.” This dwarfs both overall growth in forex, as well as retail growth in the bread-and-butter securities markets.

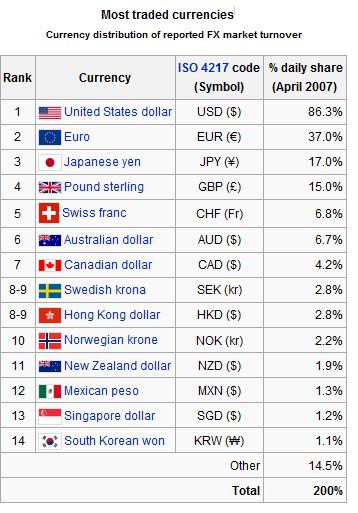

One trend worth drawing attention to is that new investors are focusing on the most popular currency pairs. [See Chart below, courtesy of Wikipedia]. It has been proposed that this is because of widening spreads (i.e. more PIPs) on less liquid pairs, but it is just as likely being caused by investors applying the stock market logic of “buy what you know” to forex. It is understandable that those new to the game would want to get their feet wet by dabbling in the Euro/Dollar/Yen, rather than diving right in to niche currencies such as the Mexican Peso or even Korean Won, whose movements are both more volatile and more difficult for the average trader to understand.

Source:www.forexblog.org